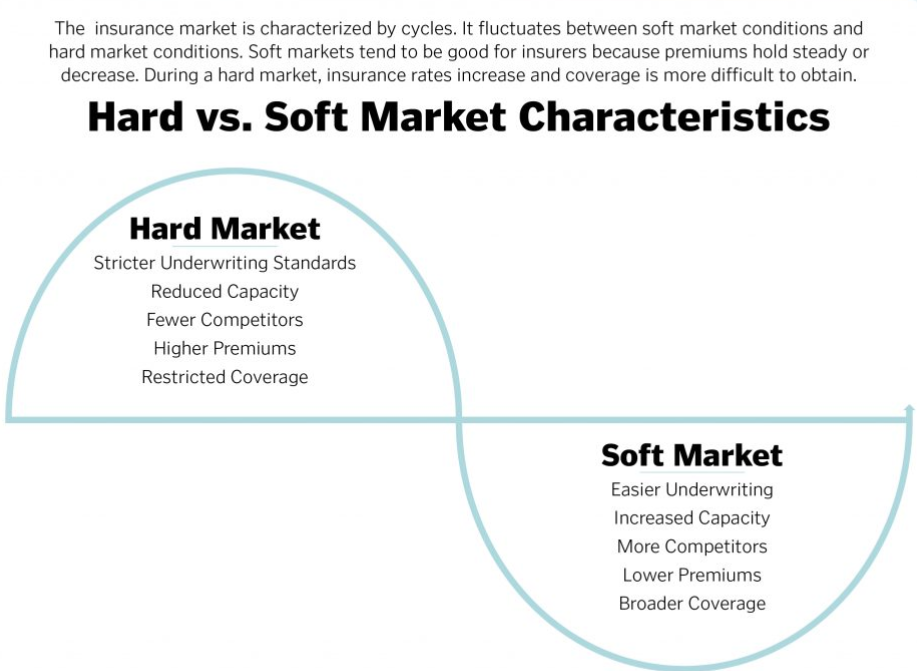

Colorado’s “hard insurance market” of 2024

What this is and how it affects you

In Colorado, home and auto insurance is getting pretty crazy. We are right in the middle of a “Hard Insurance Market.”

Hard Insurance Market = A period when insurance premiums increase, the supply of insurance decreases and coverage terms are restricted. This will make insurance more expensive and harder to obtain.

Right now, in 2024, insurance companies are doing the following:

1) They are increasing premiums

2) They are getting more picky about what they will and what they will not insure

3) They are finding ways to cover less and less

This is the hardest insurance market of our lifetime. Forces are happening in our economy that are putting tremendous pressure on insurance companies. It is almost a perfect storm.

- Increased premiums: Homeowners insurance policies are receiving 30% to 50% increases in premium. Auto insurance policies are receiving 25%-40% increases in premium

- Insurance companies are getting picky: Many homeowners insurance companies simply don’t want new business right now and they are cancelling thousands of existing homeowners insurance policies.

- Insurance covering less and less: When policies renew, sometimes an insurance company will announce that the policy is losing a coverage endorsement, or maybe they are changing the way that they cover a roof.

Insurance companies are searching for ways to make a profit and it is challenging with what is going on.

Reason #1: Increased cost of labor and materials

-Since the Covid Pandemic, the cost of labor and materials has skyrocketed. This is affecting home and auto insurance in a substantial way.

***Every auto claim is more expensive now than ever:

-Increased costs to repair a vehicle after a hail storm

-Increased costs to repair a vehicle after an auto accident

-Increased medical and litigation costs when there are injuries

***Every home insurance claim is more expensive now than ever:

-Increased cost to replace a roof that is damaged by hail

-Increased cost to replace damage in a home that is the result of water damage

-Increased cost for any other damage in a home

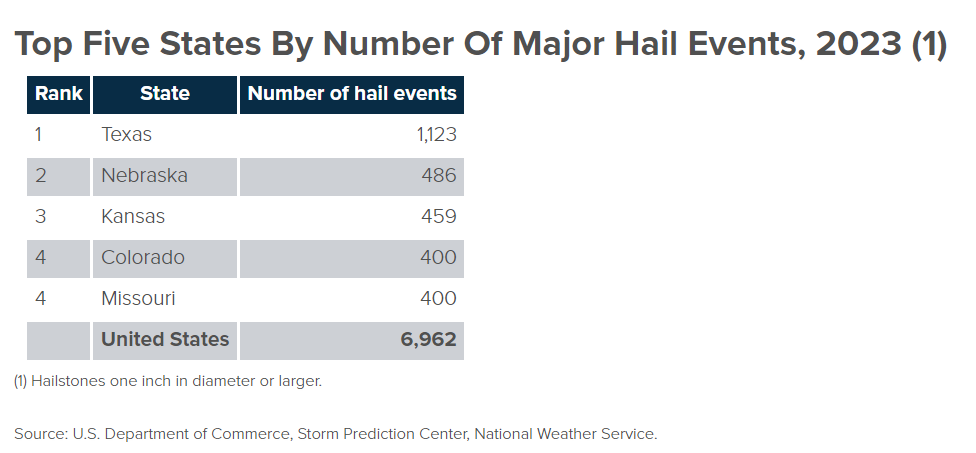

Reason #2: Hail in Colorado

-Colorado is located in the heart of “hail alley” which is a part of the country that receives the highest frequency of large hail in North America and most of the world. In the past 10 years, hailstorms have caused more than $5 billion in insured damage in Colorado.

-Up to one-half of our homeowners insurance premium may be going toward hail and wind damage costs.

-Source: http://www.rmiia.org/catastrophes_and_statistics/Hail.asp

-Not only has the number of hail storms been up, the cost to replace a roof has almost doubled in the past few years. This is a bad combination for homeowners insurance costs.

Reason #3: Wildfires and other events in Colorado and around the country

-Wildfire is a growing threat in the Rocky Mountain Region where population is booming in the mountains and foothills.

Reason #4: Laws

-After the Marshal Fire, the Colorado legislature has written new laws that protect the home owner, but cause insurance rates to go up for everyone.

-Insurance companies in Colorado can no longer decide which breeds of dogs they will and will not insure

-Insurance companies in Colorado are required to offer a certain amount of coverage for personal property and other coverages. Consumers have less customization options because insurance companies are required to offer certain coverages.

-While many of these laws have a good intent, they can often cause insurance companies to raise premiums for everyone.

What we are seeing in the marketplace:

-The average homeowners insurance premium is increasing 30% to 50%

-Insurance companies are requiring certain minimum deductibles

-Insurance companies are starting to insure roofs at an “actual cash value” basis instead of replacement cost

-The average auto insurance premium is increasing 24% to 45%

-Insurance companies are cancelling many people.

-Some companies have a new rule that says that if you have one claim in the past five years, you are not eligible for coverage with them.

-Companies are looking at every risk with a magnifying glass.

-Companies are getting bold as to what they will not cover. A company announced that if a young driver gets their permit, if the young driver is not listed as a driver on the auto insurance policy as a driver, even if they don’t have their license, they will not be covered

Recommendations that we have for our clients

-Changing insurance companies is not always the best option. A new insurance company will “re-underwrite” you. They might find a reason to cancel you within 90 days of starting the policies.

-Be careful not to file small insurance claims. You might get some money in the short term, but you will pay for it in the long term. Call our office and we will give you claims guidance if you ever need it. If you have an emergency in an evening, weekend or holiday, call Jared’s call phone!!

-Stay in closer contact with your insurance agent for guidance for certain situations.

-Keep your insurance with an INDEPENDENT insurance agent who understands the market. Only an independent agent can do this.

-Take more risk upon yourself and increase your deductibles…and save money on your insurance premiums

-Add “Service Line Coverage” when you can.

-Don’t reduce coverages to expose yourself. Now is a time when you need good coverages.

-Add telematics to your auto insurance policy to lower your premium.

We want to be your insurance agency for life. Please let us know if we can review your insurance policies with you.

Jared Ullrich, Ullrich Insurance

-For questions, please reach out to me anytime!